Download CICI Bank RTGS / NEFT Form PDF using the download link given below….

| PDF Name | ICICI Bank RTGS / NEFT Form PDF |

| No. of Pages | 1 |

| PDF Size | 0.45 MB |

| Language | English |

| Tags | Application Form, ICICI Bank Form |

| PDF Category | Banking & Finance |

| Published/Updated | August 1, 2021 |

| Source / Credits | icicibank.com |

| Uploaded By | MyPdf |

Download ICICI Bank RTGS / NEFT Form PDF

ICICI Bank, like many other banks in India, provides its customers with the option of transferring funds using RTGS (Real Time Gross Settlement). If you are looking for the RTGS form for ICICI Bank, you can find it on the bank’s official website or visit any of its branches to obtain a physical copy of the form.

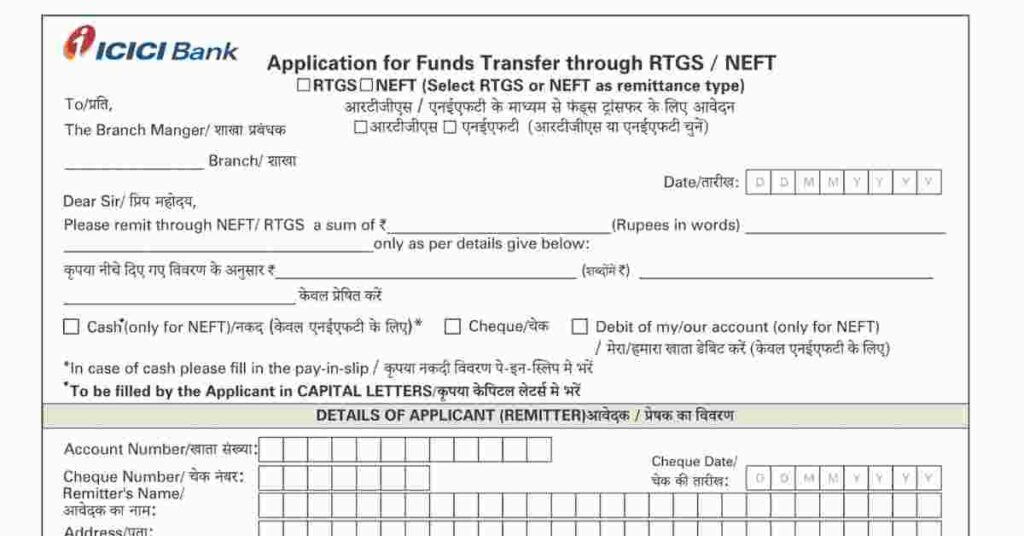

Here are the details you need to fill in the RTGS form:

- Name of the sender

- Account number of the sender

- Bank and Branch of the sender

- Name of the beneficiary

- Account number of the beneficiary

- Bank and Branch of the beneficiary

- RTGS/NEFT amount (in figures and words)

- Reason for the transaction

- Contact details of the sender

Once you have filled in the form, you need to visit your ICICI Bank branch and submit the form along with a cheque for the RTGS amount. The bank officials will then process the RTGS request, and the funds will be transferred to the beneficiary’s account in real-time.

ICICI Bank RTGS/NEFT Form Fill up – Important Information

Certainly, here is additional information about RTGS and how it works with ICICI Bank:

- Timings: RTGS transactions can be initiated between 7:00 am and 6:00 pm on all working days, except on national holidays.

- Cut-off time: The cut-off time for RTGS transactions with ICICI Bank is 4:30 pm, which means that requests received after 4:30 pm will be processed on the next working day.

- Transaction limit: There is no upper limit for RTGS transactions with ICICI Bank, but the minimum transaction limit is ₹2 lakh.

- Speed: RTGS transactions are processed in real-time, which means that the funds are transferred from one bank to another in a matter of minutes.

- Fees: ICICI Bank charges a fee for RTGS transactions, and the fee depends on the bank and the amount of the transaction.

- Confirmation: After the RTGS transaction is processed, the sender and the beneficiary will receive a confirmation message, either via SMS or email, containing the details of the transaction.

- Traceability: RTGS transactions with ICICI Bank are fully traceable, and the sender and the beneficiary can track the status of the transaction by using the reference number provided in the confirmation message.

- Security: RTGS transactions with ICICI Bank are highly secure, as they are processed in real-time and are monitored by the Reserve Bank of India (RBI).

Note: RTGS has a minimum transaction limit of ₹2 lakh, and the funds are transferred on a real-time basis, so it is a more secure and convenient option for high-value transactions.

So, don’t delay and download the PDF from the link given below.

List of Required Information:

Applicant’s Details to be filled:

- Applicant Name as in Bank A/c

- Applicant Account Number

- Adress

- Mobile Name

- Email id

Beneficiary’s Details to be filled:

- Beneficiary’s Name

- Beneficiary’s Account Number

- Bank Name

- IFSC Code

- Branch Address

You can download the ICICI Bank RTGS / NEFT Form PDF the link given below:

Report This: If you have any problem with this pdf such as broken link/copyright material please feel free to contact us.